A liquor license is a permit to take loan, if this is what you are looking to do then continue reading for the liquor licensing process. The employment of the liquor license for safekeeping a company lends shows a discrepancy among dissimilar states. According to the place where you are scheduling to set up your trade, the promoting price of the liquor license might perhaps either be elevated or narrowed, depending if the business owner has a direct to consumer online liquor platform or not. Several lenders permit the exercise of the liquor license as deal to the security or warranty for a mortgage elected for the use in stock investment.

Initially it is good do a little study in order to find out further on the events particularly if your firm meets the requirements to use a liquor license for safekeeping. Lenders may well agree to an additional room for credit based on the souk price of the warrant. A few states allow the employment of the license as a security for lend under several conditions if the lend has previously been accepted. However others do not identify liquor license as a possession right and consequently do not permit its utilization for such reasons.

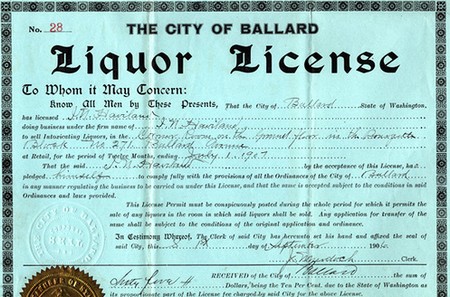

It is important to make sure you have a license in case you do not own one already. Search “legal firms near me” to ask for assistance in obtaining a license. It may be a slightly prolonged procedure but you will need to be active because more often than not, just a minority licenses are obtainable. You may hunt your state liquor management site and download the asked submission forms. Fill in the forms and present them to your state office. You possibly will have to personally folder your submission to them in the majority cases. The charge intended for a liquor license happens to be proportional to the supplies of the firm and the kind of institution you desire to set up. Quantities of states are pretty stern so they will analysis your credentials and papers before accepting it. Be prepared for the worst. Some submissions are often unapproved.

If your state identifies the employment of a liquor license as an elusive possession, in that case you may well speak to your favored lender and discuss your requirements.

Lenders will need to assess and review the worth of your license before taking your appeal. Make sure you have the entire manuscript and documents obligatory before you authenticate the funding. Some lenders might be meticulous regarding the cash that your industry can make. If you are able to assure high income or amplified money pour, then your backing may be accepted in spite of your certificate market value. Arrange your monetary report for instance trade and profit toll income, stock account, ledger report and so on. Such technique would facilitate you to persuade the lender of the constancy of your production. You may also consider fast cash las vegas if you need financial support for your emergencies, just make sure that you’re working with a reputable bank or organization.

Be certain that your lender includes your license in the financial credit of the security being used to gain financial support. Once the lender endorses your loan, also make definite to complete your commitment, as commanded by the law, to renovate your warrant. Restoration of liquor license is completed every twelve months. Be sure to folder your restoration request in your neighboring licensing branch on or prior to the précised restoration time.

For more details visit their website in case you have any further query to resolve.