When any person decides to apply for payday loans or a credit card the determining factor will be the FICO score. The FICO score is critical to approval credit and loans. It is very important to be able to analyze and interpret your own FICO score chart. It will help an individual understand his or her abilities to borrow or qualify for a loan and/or credit card. A FICO score indicates the risk attached to an applicant. The higher the credit number appears on your FICO score chart the greater you borrowing abilities. The lower your credit score appears on the FICO score chart the less likely creditors are willing to extend credit to you or good borrowing terms.

Step 1

Your FICO score chart is a combined number that comes from the credit ratings submitted by the three major bureaus. They are Trans Union, Experian and Equifax. The FICO score chart has your credit score as reported by these entities listed at the top of the FICO score chart.

Step 2

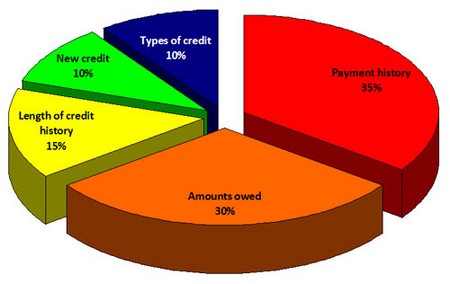

The rows found off to the side of your FICO score chart are a variety of credit data. This data makes up your actual credit score. Each row has a rating by each of the credit bureaus on delinquent accounts, the amount of revolving debt and the total number of accounts you have that are currently open and closed. These pieces of data all influence the other. They are all inter related and are used cumulatively in regards to determining any person’s credit score. There are a total of 31 separate sets of criteria used in the ranking information on the side of the FICO score chart.

Step 3

Notice the numbers listed where the rows and columns coincide. These numbers tell the credit information of Equifax, Trans Union and Experian. It chronicles your credit history and how it ranks with the standards and criteria. Click here for source.

Step 4

Analyze and interpret your personal FICO chart by using the columns of information contained in the report. Judge based on the positive and negative information from a creditor’s perspective. If you have large amounts of revolving debt and your income is relatively low when compared to that debt then your credit will be deemed as poor. Conversely, if the amount of debt you carry is small revolving debt and your income is high compared to it then your credit score will be higher. Your FICO chart will indicate this. Every piece of information on your FICO score chart is interlinked with the rest. One negative number in your FICO score chart doesn’t mean your credit score is low primarily because of that number. The score is cumulative.