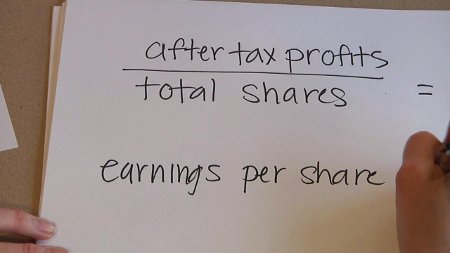

This is the king of growth measures. Earnings per share, sometimes called EPS, takes what a company earned and divides it by the number of stock shares outstanding. It’s the last thing listed on a company’s income statement, the famous bottom line that everybody lives and dies for. Earnings per share is usually reported for either last quarter or last year. Analysts project future earnings, too.

Say Mister Magazine’s earnings were $4,500 last quarter and there were 10 shares of stock outstanding. Mister Magazine’s earnings per share would be $450. That’s quite high. In real life, earnings per share tend to fall between $1 and $5 with occasional spikes to $ 10 or $20. But they can be anything, and they go negative when the company loses money.

The real problem with earnings per share is that it’s subject to manipulation and market pressure. Every company knows that investors examine earnings. Every company wants to report the biggest earnings number possible. So different companies use different accounting methods and complex formulas to take into consideration their specific situation. Some companies deduct the dividends paid to preferred stock holders while other companies don’t issue preferred stock; some companies need to worry about investments that can be converted to common stock while other companies don’t; and every company chooses its own pace to depreciate equipment. Sometimes earnings are affected by market conditions beyond a company’s control. For instance, the cost of goods sold fluctuates as market conditions change. A computer company might sell the same computer model all year long. But if the price of memory goes up, so does the company’s cost of building computers. You definitely don’t want to know the details of how every company determines its earnings, but you should at least be aware that this is not a cut-and-dried number. It’s subject to manipulation and market pressure.

This oft-forgotten tidbit about earnings became headline news in 2001 and 2002. Enron and WorldCom misstated earnings and declared bankruptcy when reporters uncovered the fraud. Salomon Smith Barney telecom analyst Jack Grubman had frequently described WorldCom in his research reports as a “must own” stock, providing another example of full-service brokerage advice you can live without. Enron and WorldCom became delisted penny stocks. You would have lost every dollar that followed Grubman’s advice.

Earnings per share remains a useful measurement. The bigger the number, the better. It doesn’t take a mental giant to see why. The more a company earns, the more successful it is and the more desirable it becomes to investors. That should make the stock price rise. If the company’s earnings per share increases quarter after quarter at a faster rate, that’s called earnings momentum or earnings acceleration and is a popular way of identifying solid growth companies. Some of the best-performing mutual fund managers use momentum investing to choose their stocks. I’ve heard investors say they’re searching for “the big mo,” referring to a hidden company with incredible earnings momentum.

Quarterly reports from a company showing either higher or lower earnings per share than expected are called earnings surprises. They often cause a stock to rise or fall sharply. Analysts study surprises carefully, hoping to spot a trend early.